VALUATION YOU CAN TRUST!

If you have any questions about our appraisal services, please feel free to get in touch with us!

MCB Valuation uses technology, data, and knowledge of the local market to deliver quality appraisals based on integrity and objectivity.

We offer a wide variety of services, all tailored to property appraisals.

Here’s just a few of our specialties:

We offer a wide variety of services, all tailored to property appraisals.

Here’s just a few of our specialties:

Matt grew up in Fremont, California. After graduating from California Poly Technic State University with a B.S. in Business Administration, he moved back up to the Bay Area, relocating to Contra Costa County.

He began as a trainee with a small appraisal firm in Alameda County. After getting his trainee license, he transitioned to working for a large bank as a staff appraiser, receiving his State Certified Residential Appraisal License. During this time, he worked on various appraisals consisting of single-family residential homes, vacant land, and 2-4 unit properties. His primary focus was luxury estates, complex properties, and residential acreage. He is FHA certified.

Since starting MCB Valuation, he’s applied his market knowledge to assist attorneys, realtors, and homeowners in appraisals for private and lending purposes. Whatever your residential appraisal needs may be, Matt with MCB Valuation can assist.

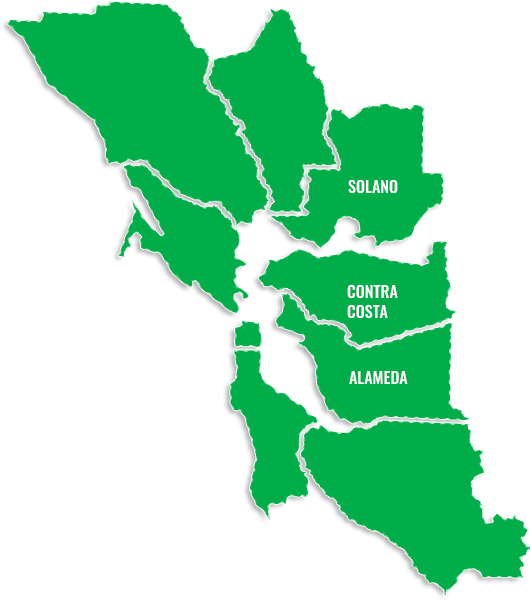

We are located in Contra Costa County, covering the San Francisco East Bay. Coverage includes Contra Costa County, Alameda County, and Solano County.

The mortgage rate a lender offers is determined by a combination of factors that are specific to you and larger forces that are beyond your control. Some of the major influences you can control are credit score, the home price and loan amount, down payment, your employment history, the term of the loan (commonly 15 years or 30 years), interest rate type (fixed or adjustable), and loan type (Conventional, FHA, USDA, and VA loans). Factors you can’t control are the U.S. economy, global economy, and Federal Reserve.

Here is an overview of some common mortgage interest rate products. The interest rates reflect Mortgage News Daily Rate Index, which tracks the day-to-day movement in mortgage rates. It’s driven by real-time changes in actual lender rate sheets.

This is an objective summary; the applicant may fall above or below where the current interest rates are tracking.